Aug. 05, 2023

Lead in

On July 19, Greenpeace and North China Electric Power University jointly held a seminar on overseas renewable energy investment and financial innovation of Chinese enterprises in Beijing. Bai Xuetian, General Manager of Yingli YC Solar International Business Department attended the meeting and participated in the round table discussion.

Focus on the development of renewable energy, write a chapter of green future

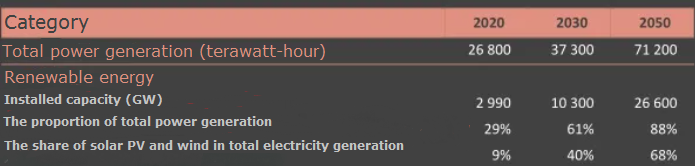

Under the background of global warming and the depletion of fossil energy, the development and utilization of renewable energy has received increasing attention from the international community, and vigorously developing renewable energy has become the consensus of all countries in the world. According to the International Energy Agency’s (IEA) Net-Zero Emissions Roadmap for the Global Energy Sector 2050, the world will achieve net-zero carbon emissions by 2050, and nearly 90% of electricity generation will come from renewable sources, of which solar and wind together account for nearly 70%. The global energy structure will also enter a low-carbon energy era dominated by renewable energy.

Under the “dual carbon” goal, China's renewable energy has developed rapidly, industrial competitiveness is prominent, and the recognition of China’s renewable energy products and technologies in overseas markets has been increasing, at the same time, the demand has been increasing. It is understood that in the past decade, with the development of China’s economy and the strengthening of corporate strength, overseas investment has developed rapidly, and energy companies are becoming the main force. At the same time, Chinese companies face multiple challenges in investing in renewable energy overseas.

Zhang Kai, deputy director of Greenpeace East Asia, opened the meeting by saying that with China’s announcement to stop building new overseas coal power projects, the development of global renewable energy technology and the strengthening of energy transition intentions in various countries, China’s overseas investment management system is becoming more and more complete, and the management responsibilities of relevant departments are gradually clear. The basic conditions for Chinese enterprises to participate in overseas renewable energy investment are constantly improving, and the total investment in overseas wind power, photovoltaic and other projects is on the rise, creating a new situation. He said that he hope to hear more voices of Chinese enterprises in overseas renewable energy investment and financial innovation practices in the future, and jointly promote the realization of sustainable development goals.

Give full play to renewable energy investment collaborative effects to promote sustainable development goals

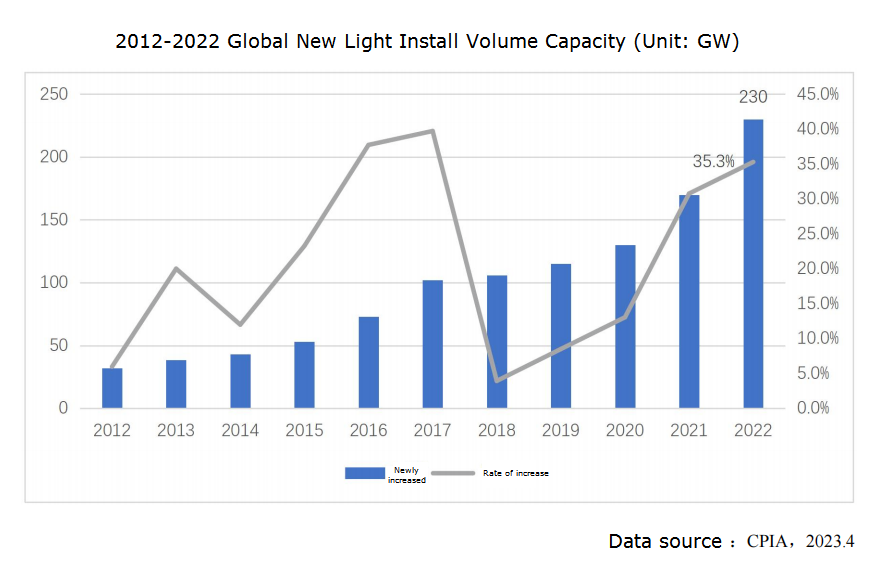

Due to the unique advantages of solar energy in terms of solving energy and nature and energy structure adjustment, under the driving of favorable factors such as the “carbon peaks/carbon neutralization” goals, clean energy transformation, and photovoltaic “cheap Internet access”, photovoltaic power generation will accelerate the change of traditional fossil energy and complete the transformation from supplementary energy roles to the main sources of global energy supply. The future development potential is huge and it has a broad market space.

According to the China Photovoltaic Industry Association Official WeChat, the global photovoltaic installation machine was 230GW in 2022, a year -on -year increase of 35.3%. The cumulative installed capacity was about 1156GW. In 2023, the global photovoltaic market demand will continue to maintain strong.

![]()

![]()

In the round table discussion, Liu Xu, Executive Director of the International Energy Strategy Research Center of Renmin University of China, Xue Tian, General Manager of Yingli YC Solar International Business Department, Zhang Kai, Deputy Director of Greenpeace East Asia, and Tong Gang, General Manager of Investment and Financing Department of PowerChina International Group Limited, participated in the discussion on the practice of Chinese enterprises' overseas renewable energy investment.

△ The seminar on overseas renewable energy investment and financial innovation of Chinese enterprises

Liu Xu, Executive Director of the International Energy Strategy Research Centre of Renmin University of China, said that the development of renewable energy is an inevitable part of history from a macro perspective, and that Chinese companies’ investment in overseas renewable energy resources should be in close contact with the local community, pay attention to the local market demand, and play a synergistic effect of investment. He believes that the current challenges and opportunities co-exist, Chinese enterprises in overseas renewable energy investment still need to combine the macro background to think more, and actively deal with the difficulties and challenges.

Bai Xuetian, General Manager of Yingli YC Solar International Business Department, shared the practical experience and business model of overseas renewable energy investment of Chinese enterprises: at present, green and low-carbon development has become a global consensus, and countries have accelerated the process of energy transformation, and as one of the earliest enterprises in China to enter into the PV industry, Yingli Group has gone through all the development phases in the industry. As for the business model of overseas investment in equipment and technology, the first one is the investment in green production capacity, which is different from ordinary trade in goods. Exporting China’s more advantageous industries, such as renewable energy industry, overseas can improve the high-end manufacturing capacity of some host countries while enhancing their ability to cope with climate change. In addition, Bai Xuetian discussed three different types of business models: technical services, partial equity joint ventures and sole proprietorships, and shared and exchanged views on the development of project rights and EPC service models in power plant investment.

△Bai Xuetian, General Manager of Yingli YC Solar International Business Department, shared his views

Zhang Kai, Deputy Director of Greenpeace East Asia Project, believes that there are two main business models in terms of overseas renewable energy investment trends, one is the “EPC+F” model, and the other is the equity investment model, and analyses the advantages and disadvantages of the two models. In addition, there are two important points in time to pay attention to in the overall development process: first, China put forward the “Belt and Road Initiative” in 2013; second, at the 76th General Debate of the United Nations General Assembly in 2021, President Xi Jinping said in his speech that China will strongly support the development of green and low-carbon energy in developing countries, and will not build new coal power projects abroad. Secondly, President Xi Jinping said in his speech at the 76th UN General Assembly debate in 2021 that China will strongly support the development of green and low-carbon energy in developing countries, and will no longer build any new coal power projects abroad. Both of these points in time have been instrumental to a certain extent for Chinese companies to switch their investment patterns. In the future, under the empowerment of various advantages, the international market competitiveness of Chinese enterprises’ overseas renewable energy investment will be further enhanced.

Tong Gang, General Manager of Investment and Financing Department of Power China International Group said that the key to the success of Chinese enterprises in overseas renewable energy investment is to pay attention to the “selection of the country first, and then select the project”, but also to match their own risk appetite to choose the tariff mechanism, in addition, the host country’s supporting infrastructure and the degree of investment in electric power, as well as the ability of the enterprise to cross-disciplinary integration is also an important factor in determining the success or failure of the host country.

△Yingli YC Solar Overseas Market

At the conference, Rao Zhijia, Senior Investment Officer of the Asian Development Bank, Zhang Lixin, Executive Director of the Chinese Overseas Business Department of Aon-COFCO Insurance, and Sun Lei, Director of the Innovation Research Centre of Cecep HengZhun Technology Service (Beijing) company discussed how financial instruments can support the smooth development of overseas renewable energy investments.

At present, under the development opportunities of global energy transition and the flourishing green industry, we will discuss how China can accelerate its own low-carbon transition and at the same time promote healthy competition and win-win co-operation in international renewable energy investment, so as to play a more active role in the global energy transition with the help of the “stone from another mountain”.

Relying on the innovation, technology, management, brand and culture advantages that Yingli Group has accumulated over a long period of time in cultivating overseas markets, the company has been progressing towards product intelligence, positioning precision and business internationalization. Up to now, Yingli YC Solar’s products and services cover many countries and regions around the world. In the future, Yingli YC Solar will continue to give full play to its advantages in the overseas market, and work together with its partners to promote the transformation of green energy and help achieve the goal of sustainable development.

About YC Solar

Yingchen Technology:

E-mail: sales@ycsolar.com

Tel.: +86 400 666 7111

Address: Changgucheng Industrial Park, Tang County, Baoding City, Hebei Province

Hotline: 0312-7510213

Address: No. 56 Hengyuan West Road, National High tech Zone, Baoding City, China Room 1606, B-3 Office Building, Beibu Gulf Science and Technology Park Headquarters Base